If you’re a central government employee or a pensioner, chances are this question has been sitting in your head for months: Will 2026 finally bring some breathing room? With prices climbing and savings stretched thin, even a small pay change can feel personal.

Here’s the thing—the 8th Pay Commission isn’t just another policy update buried in paperwork. For many families, it could mean a better monthly budget, less stress about retirement, and a sense that years of service are finally being acknowledged.

8th Pay Commission: What’s Official So Far

The Union Cabinet, chaired by Prime Minister Narendra Modi, has approved the Terms of Reference for the 8th Pay Commission. This commission has been formally constituted and is expected to submit its recommendations within 18 months.

If everything stays on track, the 8th Pay Commission salary structure will come into effect from January 1, 2026, right after the 7th Pay Commission ends on December 31, 2025.

This follows a familiar pattern. Past pay commissions—4th, 5th, 6th, and 7th—were all implemented roughly every 10 years. So this move didn’t come out of nowhere.

What this really means is simple: a full review of pay, pensions, and service conditions is underway.

Why the 8th Pay Commission Matters More Than You Think

On paper, it’s about numbers. In real life, it’s about dignity and stability.

The 8th Pay Commission is expected to benefit:

- Around 48.62 lakh central government employees

- Nearly 67.85 lakh pensioners

That’s not a small group. These are teachers, clerks, officers, railway staff, defense personnel—people who’ve kept the system running quietly for decades.

Most estimates suggest an average salary hike of around 14%, though the actual impact will depend on the final fitment factor and allowance revisions.

8th Pay Commission Overview at a Glance

Here’s a clear snapshot of what’s being discussed right now:

| Category | Expected Details |

|---|---|

| Implementation Authority | Department of Personnel and Training |

| Expected Fitment Factor | 2.28 |

| Dearness Allowance | Likely to touch 70% by Jan 2026 |

| Implementation Date | January 1, 2026 |

| Minimum Basic Pay | From ₹18,000 to around ₹41,000 |

| Minimum Pension | Expected to increase significantly |

| Beneficiaries | Central government employees & pensioners |

| Official Portal | dopt.gov.in |

That jump in minimum pay alone tells you why this commission is getting so much attention.

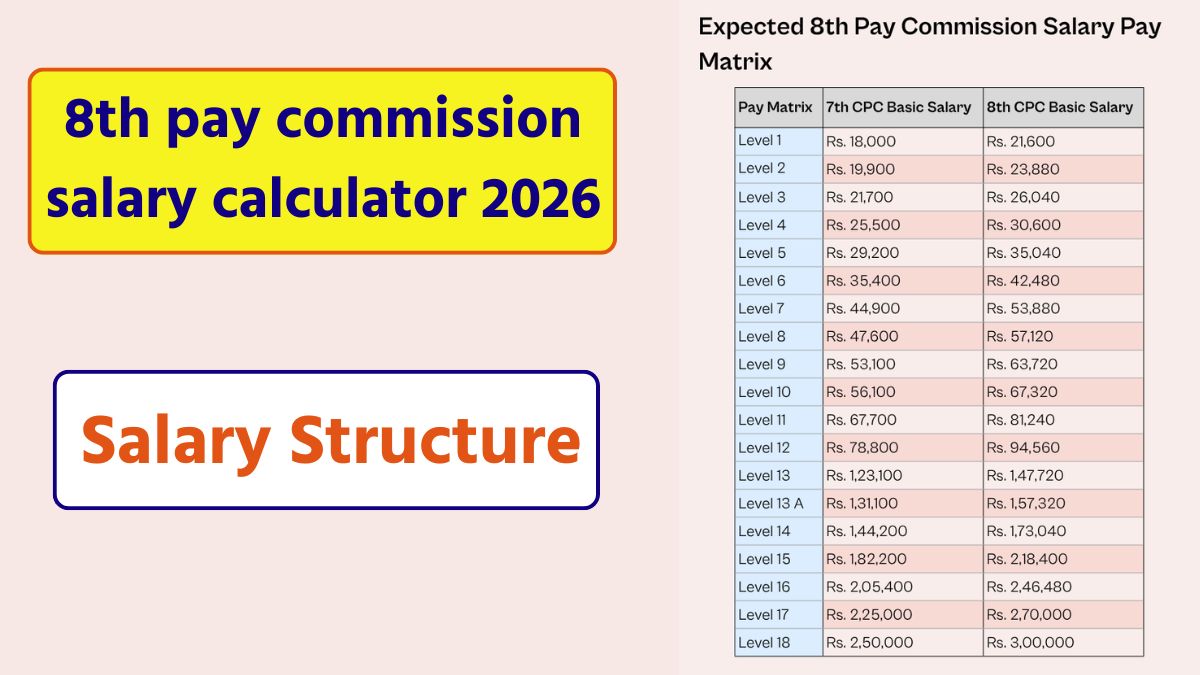

8th Pay Commission Salary Structure: What Changes

The 8th Pay Commission salary structure will revolve around three main components:

1. Basic Pay

This is the foundation. The new basic salary will be calculated by applying the fitment factor (expected 2.28) to your current basic pay.

2. Allowances

Once the basic pay increases, all linked allowances move up automatically:

- Dearness Allowance (DA)

- House Rent Allowance (HRA)

- Travel Allowance (TA)

With DA expected to be merged into the base (as it reaches around 70%), the revised calculations could look very different from what you’re used to.

3. Gross Salary

This is the final figure—the one that actually hits your bank account. It includes basic pay plus allowances, minus deductions.

What Pensioners Can Expect from the 8th Pay Commission

If you’re retired, this part matters deeply.

Under the 7th Pay Commission, the minimum pension was ₹9,000. With the proposed fitment factor of 2.28, that figure could rise to around ₹20,500.

That’s not just an increase. For many pensioners, it’s the difference between depending on family and managing expenses independently.

The goal here is clear: better financial security and timely pension disbursement.

8th Pay Commission Implementation Timeline

Pay commissions don’t happen overnight. There’s a process.

- January 16, 2025 – Formation of the 8th Pay Commission approved

- Next 18 months – Data review, consultations, economic analysis

- January 1, 2026 – Expected implementation

This timeline gives the government space to balance employee welfare with fiscal responsibility.

Who Runs the 8th Central Pay Commission

The commission is a temporary but powerful body, made up of:

- Chairperson – Leads and supervises all activities

- Part-Time Member – Provides expert input

- Member-Secretary – Handles administration, research, and reporting

Their scope covers:

- Pay structure

- Allowances

- Pension revisions

- Service conditions

Every recommendation goes through layers of scrutiny before approval.

8th Pay Commission Salary Calculator: Estimate Your New Pay

Want a rough idea of what your revised salary could look like? Here’s a simple way to calculate it.

Step-by-Step Salary Calculation

Step 1: Note your current basic pay (7th Pay Commission).

Step 2: Calculate revised basic pay

Revised Basic Pay = Current Basic Pay × Fitment Factor

(Example: ₹30,000 × 2.28 = ₹68,400)

Step 3: Calculate Dearness Allowance

If DA is assumed at 50%:

DA = Revised Basic Pay × 0.50

Step 4: Add House Rent Allowance (HRA)

- Metro cities: 27%

- Tier-2 cities: 20%

- Tier-3 cities: 10%

Step 5: Add Travel Allowance (TA) as applicable.

Step 6: Calculate Gross Salary

Gross = Basic + DA + HRA + TA – Standard Deductions

This isn’t official, but it gives you a realistic ballpark figure.

FAQs About the 8th Pay Commission

When will the 8th Pay Commission be implemented?

The expected implementation date is January 1, 2026, after the 7th Pay Commission ends.

What is the expected fitment factor?

Current estimates suggest a fitment factor of 2.28, though the final number will be confirmed in the report.

Will pensioners benefit from the 8th Pay Commission?

Yes. Pension revisions are a key part of the commission’s mandate, with a significant hike expected in minimum pension.

Is DA going to be merged into basic pay?

DA is projected to reach around 70% by 2026, and merging it into basic pay is a strong possibility.

Does this apply to state government employees?

Directly, no. But historically, states often revise their pay structures after central recommendations.